Understanding and managing cash flow is essential for businesses aiming for growth. By implementing proactive strategies like accurate forecasting through historical data analysis, categorizing expenses, and strategic decision-making (e.g., faster client payments), companies can identify potential problems early. This enables informed decisions, optimizes the cash cycle, and ensures a robust financial foundation for sustainable business growth and adaptability in dynamic markets. Key focus areas include improving cash flow forecasting tips, addressing identified issues, and leveraging these strategies to drive both short-term liquidity enhancement and long-term market competitiveness.

In today’s competitive market, understanding and optimizing cash flow is crucial for any business’s survival and growth. This article guides you through a comprehensive approach to improving business cash flow. We’ll start by breaking down the basics of cash flow management strategies and cash flow forecasting tips, then delve into effective methods for identifying cash flow problems. Learn how to implement practical solutions that not only stabilize but also enhance cash flow and growth. By the end, you’ll be equipped with actionable insights to navigate your business’s financial landscape with confidence.

- Understanding Cash Flow: The Backbone of Your Business

- Diagnosing Cash Flow Problems: Where to Start

- Implementing Effective Cash Flow Management Strategies

- Fostering Growth through Optimized Cash Flow Forecasting

Understanding Cash Flow: The Backbone of Your Business

Understanding Cash Flow is crucial for any business aiming to thrive and grow. It essentially boils down to managing the money coming in (revenues) and going out (expenses) over a specific period, allowing businesses to gauge their financial health and make informed decisions. Effective cash flow management strategies involve implementing robust forecasting tips that predict future income and expenses, enabling proactive measures against potential problems. This process is key to identifying bottlenecks and optimizing the entire cash flow cycle, which directly impacts business growth.

By embracing cash flow forecasting, businesses can avoid costly surprises, ensure they have enough funds for operations, and strategically allocate resources for investments and expansion. It’s about navigating the financial landscape with a clear vision, ensuring that every transaction contributes to the overall stability and momentum of the company. Effective cash flow management is not just about saving money; it’s about making informed choices that drive sustainable growth.

Diagnosing Cash Flow Problems: Where to Start

Diagnosing Cash Flow Problems is the first step in improving business cash flow. To start, review your financial statements, focusing on the income statement and balance sheet. Look for discrepancies between revenue and actual collected funds, known as accounts receivable. Slow-paying clients or inaccurate invoicing can be significant contributors to cash flow issues.

Additionally, assess your expenses by categorizing them into fixed (rent, salaries) and variable (supplies, marketing). Identify areas where costs exceed expectations and investigate potential inefficiencies. Cash flow forecasting tips involve predicting future income and expenses using historical data. By implementing these cash flow management strategies, you can gain a clear understanding of your business’s financial health and optimize cash flow for sustainable growth.

Implementing Effective Cash Flow Management Strategies

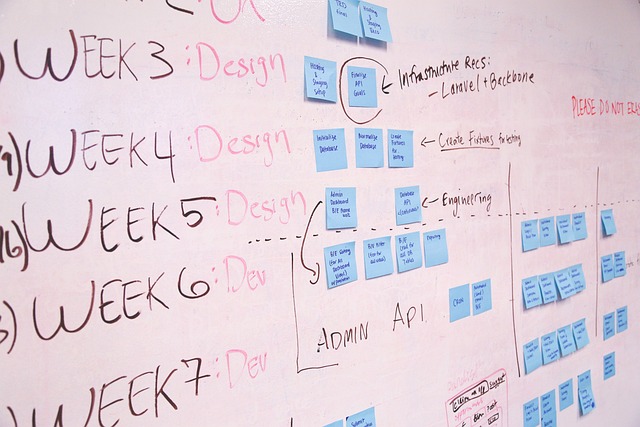

Implementing effective cash flow management strategies is paramount for improving business cash flow and ensuring sustainable growth. Start by integrating robust cash flow forecasting tips into your operations. This involves meticulously tracking income and expenses, accounting for seasonal variations, and projecting future trends. Accurate cash flow forecasting enables you to identify potential cash flow problems before they escalate, allowing for timely interventions.

Additionally, focus on optimizing cash flow through strategic financial decisions. Encourage faster payment from clients, streamline invoicing processes, and negotiate better terms with suppliers. These measures can significantly improve the timing of cash inflows and outflows, enhancing overall liquidity. By implementing these cash flow management strategies, businesses can harness control over their financial health, fostering a robust foundation for growth and stability.

Fostering Growth through Optimized Cash Flow Forecasting

Optimizing cash flow is a powerful tool for fostering business growth. By implementing effective cash flow forecasting tips, businesses can identify potential problems early on and make informed decisions to navigate financial challenges. Accurate cash flow forecasting allows entrepreneurs to predict future cash positions, enabling them to adjust spending, negotiate better terms with suppliers, and seize opportunities for strategic investments.

Cash flow management strategies that incorporate regular and detailed forecasting can significantly enhance a company’s overall health. It ensures that the business is not only surviving but thriving by making efficient use of its financial resources. This proactive approach to cash flow and growth can give businesses a competitive edge in today’s dynamic market, allowing them to adapt quickly and capitalize on emerging trends.