Effective cash flow management is vital for businesses to thrive during economic downturns. By implementing strategies like forecasting, cost reduction, supplier negotiations, and efficient invoicing, companies can optimize their cash position, identify issues early, and ensure financial resilience. This proactive approach enhances business growth prospects by improving cash flow and enabling strategic investments.

In today’s economic landscape, effective cash flow management is crucial for businesses aiming to survive and thrive during lean times. Understanding cash flow—its importance and common challenges—is the first step towards stability and growth. This article guides you through essential strategies to optimize your business’s cash flow, offering insights on forecasting tips to enhance accuracy. Learn how identifying problems early can empower your firm, ensuring resilience and fostering expansion in an ever-changing market.

- Understanding Cash Flow: Its Importance and Common Problems

- Implementing Effective Cash Flow Management Strategies

- Forecasting for the Future: Tips to Improve Cash Flow Accuracy

- Optimizing Cash Flow for Business Growth and Stability

Understanding Cash Flow: Its Importance and Common Problems

Cash flow is a vital indicator of a business’s health and sustainability, especially during challenging economic periods. Understanding and effectively managing cash flow is crucial for businesses aiming to navigate lean times successfully. It involves recognizing that cash flow isn’t merely about having enough money but also ensuring funds are available when needed to meet operational expenses, fund growth, or take advantage of opportunities.

Common issues in cash flow management include unexpected cash outflows, slow-paying customers, inadequate forecasting, and poor inventory management. Identifying these problems is the first step towards optimizing cash flow. Businesses can improve their financial position by implementing strategic cash flow management strategies, such as reducing costs, negotiating better terms with suppliers, offering incentives for prompt payments, and utilizing cash flow forecasting tips to anticipate future needs. By adopting these practices, companies can foster a healthier cash flow, ensuring they remain resilient during economic downturns and are well-positioned for growth when the economy recovers.

Implementing Effective Cash Flow Management Strategies

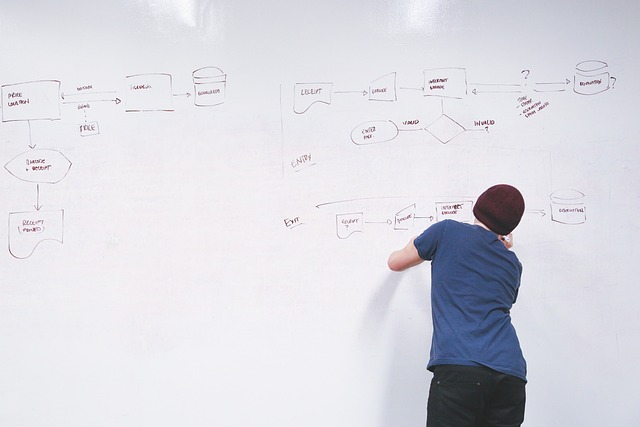

Implementing effective cash flow management strategies is vital for businesses aiming to navigate lean times successfully. Start by embracing cash flow forecasting tips that enable you to predict and plan for future income and expenses accurately. This involves analyzing historical data, understanding seasonal trends, and considering market fluctuations. By doing so, you can identify potential cash flow problems early on and take proactive measures.

Additionally, optimizing cash flow through strategic decisions is key. Encourage faster payment from clients, negotiate better terms with suppliers, and streamline your invoicing processes. These practices not only improve business cash flow but also enhance overall financial health and sustainability, fostering an environment conducive to growth and resilience during challenging periods.

Forecasting for the Future: Tips to Improve Cash Flow Accuracy

Accurate cash flow forecasting is a powerful tool for businesses looking to navigate lean times successfully. By predicting future income and expenses, companies can make informed decisions about spending and investment. Start by collecting historical financial data and analyzing trends. Identify seasonal fluctuations, sales cycles, and recurring costs to establish a baseline for your business’s typical cash flow patterns. This foundation will enable you to anticipate future variations and potential cash flow problems.

Implementing robust cash flow forecasting methods involves setting aside dedicated time for analysis and regularly updating projections. Utilize accounting software that offers cash flow forecasting tools or create customized spreadsheets to track key metrics. Consider incorporating macroeconomic indicators relevant to your industry for a broader view of market trends. Regularly reviewing and refining these forecasts allows you to optimize cash flow, identify growth opportunities, and ensure your business remains resilient during challenging periods.

Optimizing Cash Flow for Business Growth and Stability

Improving business cash flow is a critical aspect of ensuring long-term stability and growth. By implementing effective cash flow management strategies, businesses can navigate lean times with confidence. One key tip for optimizing cash flow involves forecasting accurately. Businesses should anticipate expenses, sales trends, and seasonal variations to predict their future cash positions. This enables proactive decision-making, such as adjusting inventory levels or renegotiating supplier terms to free up funds.

Additionally, identifying cash flow problems early on is essential. Regularly reviewing accounts receivable, payable, and overall liquidity can reveal potential bottlenecks or areas for improvement. Optimizing payment terms with suppliers, offering incentives for prompt payments from customers, and streamlining processes to reduce delays in cash collection are all valuable cash flow forecasting tips. These measures collectively contribute to a healthier cash flow, enabling businesses to invest in growth opportunities and maintain resilience during challenging periods.